Shaping the Digital Future of Ghana’s Newest Bank

At the outset of building a new digital bank in Ghana, there was a need to deeply understand local user expectations and behaviours in order to design an experience that felt intuitive, trustworthy, and truly relevant from day one.

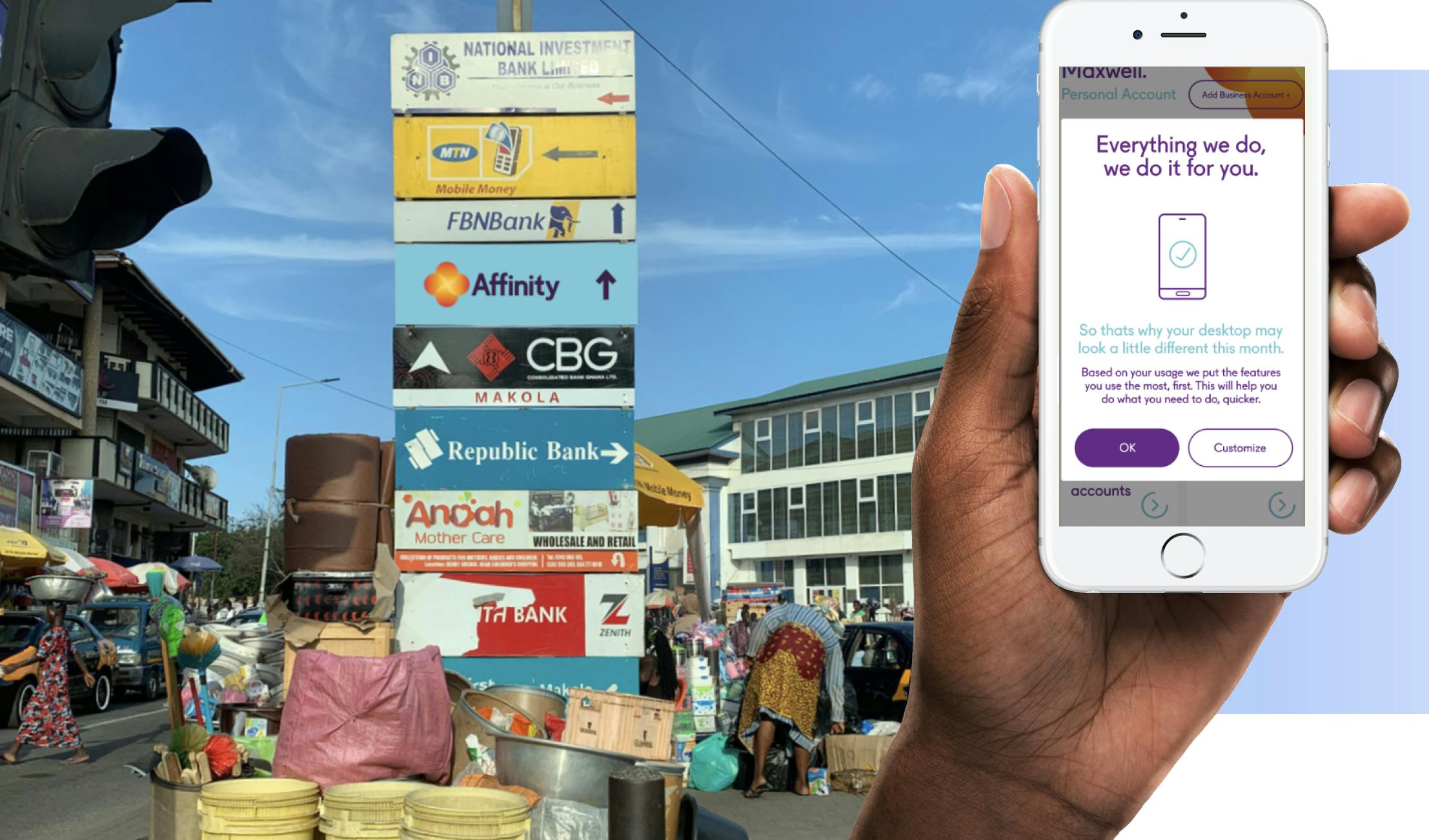

Affinity, the first fully digital banking platform to enter the Ghanaian market, faced the challenge of designing an experience that felt intuitive, relevant, and trustworthy. They risked defaulting to generic banking patterns that didn’t reflect the realities, behaviours, or expectations of Ghanaian users. Critical decisions around content hierarchy, personalisation, and data transparency needed to be grounded in real insight. For a platform built entirely online, getting these foundations right was essential, not only to build trust and usability, but to ensure access for users who may lack formal documentation or prior digital banking experience. CraigWalker was engaged to deliver a future-ready banking experience, combining deep local insight with a digitally native approach.

Learn More

The project in numbers

3Tier feature layout based on user engagement

20+ User needs and behaviours mapped

3Brand rules applied across all touchpoints

Designing for Context, Culture and Change

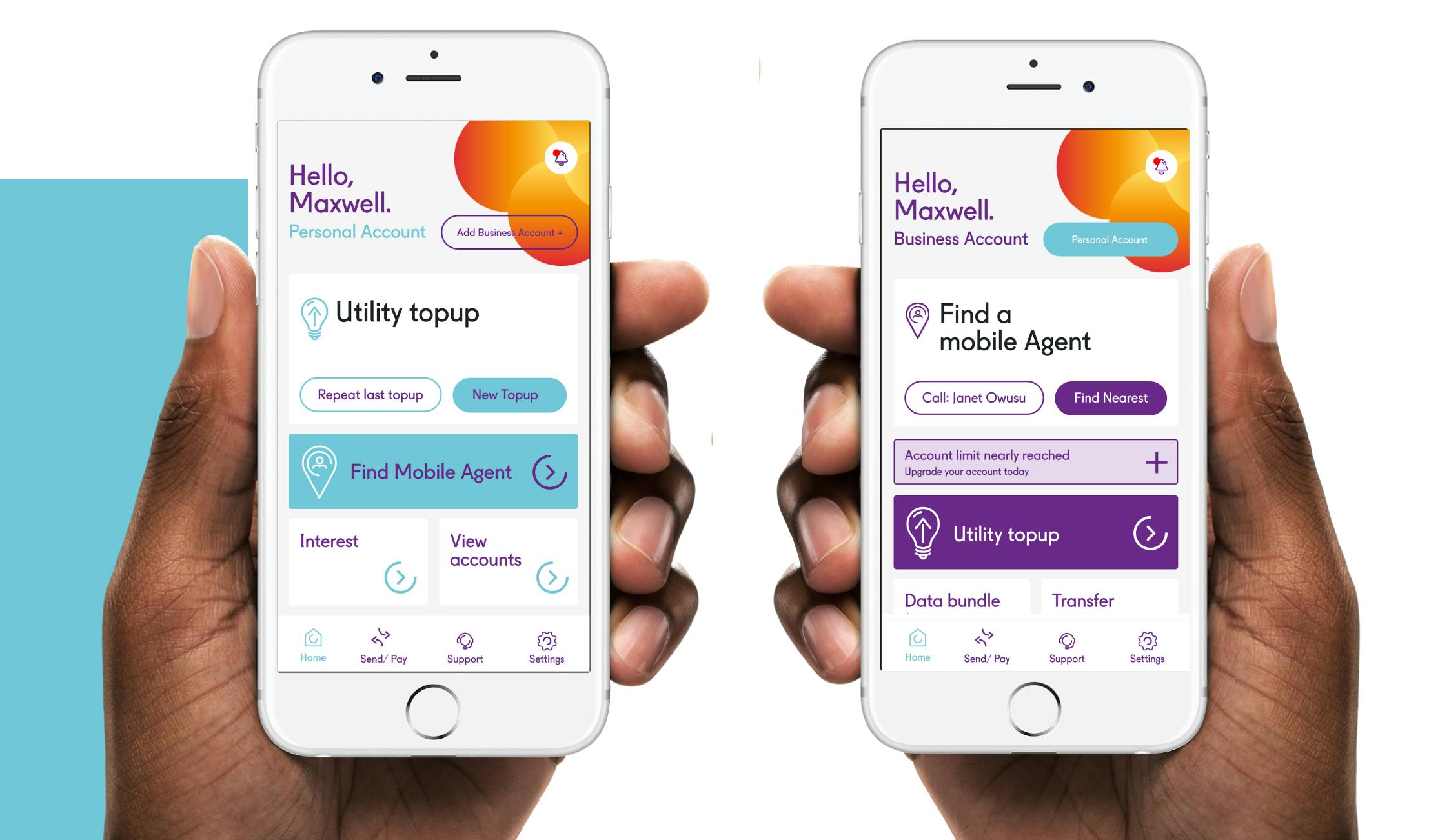

To ensure the digital banking experience was truly relevant to Ghanaians, we began with in-depth design research and virtual workshops to uncover user needs, behaviours, and barriers. This discovery process grounded the entire approach, allowing us to move beyond assumptions and design with cultural and contextual clarity. We translated these insights into actionable design outcomes, developing a home screen experience that adapts to user behaviour, differentiates personal and business accounts, and reflects brand identity at every touchpoint. In parallel, we created a permissions framework that asks for data only when needed, clearly communicates its value, and puts users in control of their experience.

Banking That Learns, Adapts and Delivers the Right Features at the Right Time.

Guided by in-depth research insights, the project delivered a digital banking experience tailored to the needs of Ghanaian users from the ground up. At its core is a dynamic, personalised home screen that adapts to individual behaviours, surfacing the right features at the right time and clearly distinguishing between business and personal accounts. Supporting this is a thoughtfully crafted set of UI and UX patterns that prioritise clarity, speed, and trust. To ensure transparency around data use, we also developed a flexible library of permission patterns designed to request information contextually, explain its purpose, and reinforce user control. Together, these elements form a system that is responsive, respectful, and ready to grow with its users.